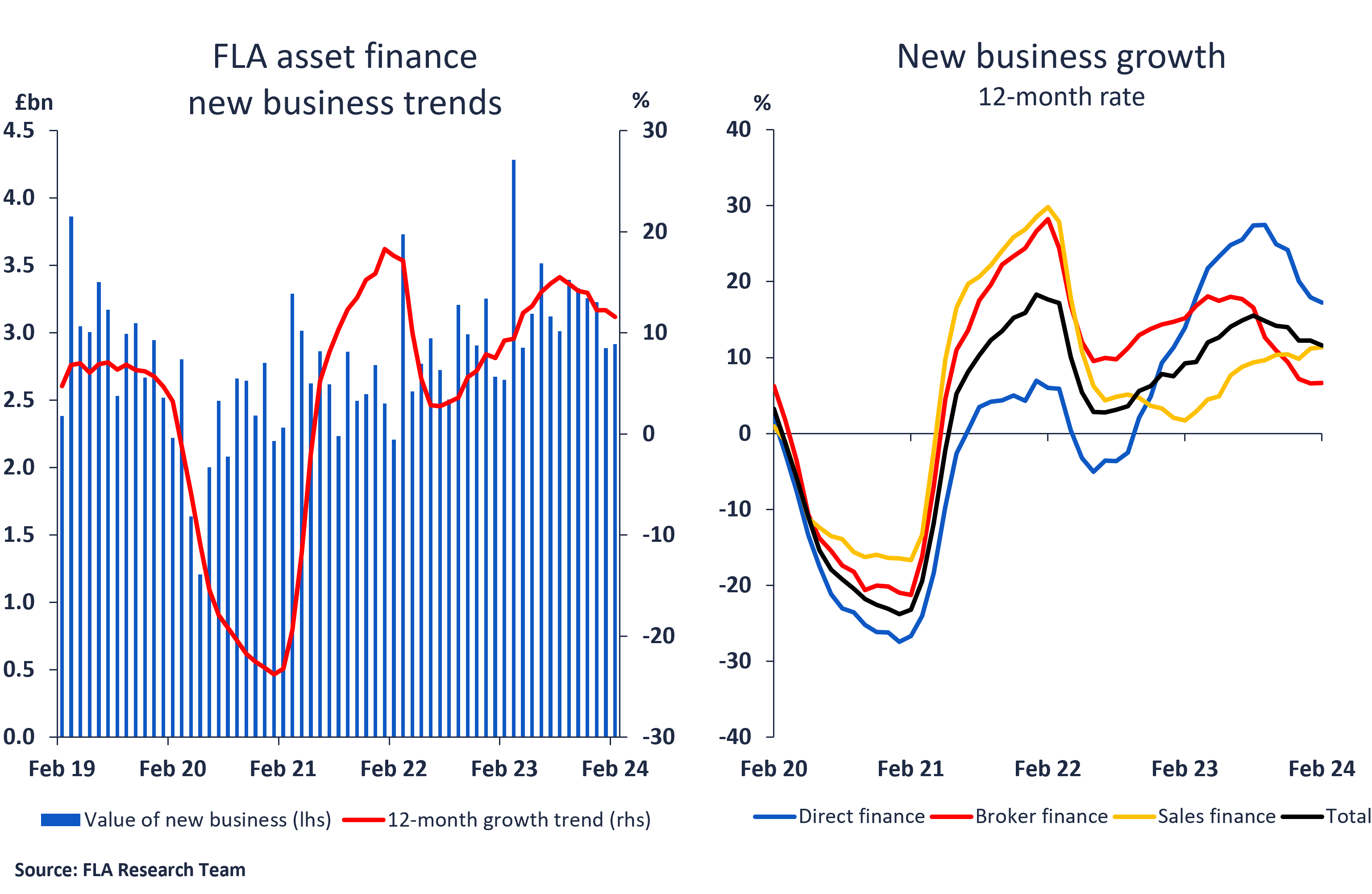

New figures released by the Finance & Leasing Association (FLA) show that total asset finance new business (primarily leasing and hire purchase) grew in February 2024 by 10% compared with the same month in 2023. In the first two months of 2024, new business was 9% higher than in the same period in 2023.

The business new car finance and commercial vehicle finance sectors reported new business up in February by 40% and 7% respectively, compared with the same month in 2023. New business in the plant and machinery finance and business equipment finance sectors fell by 13% and 5% respectively, over the same period.

Commenting on the figures, Geraldine Kilkelly, Director of Research and Chief Economist at the FLA, said:

“Growth in the asset finance market since April of last year has been predominately supported by higher levels of new business in the new car finance and commercial vehicle finance sectors. By contrast, the machinery and business equipment finance sectors have reported weaker demand. New finance provided for construction equipment, for instance, fell by 16% in the twelve months to February 2024.

“Lending to SMEs by FLA asset finance providers grew by 4% in February and reached £23.6 billion in the twelve months to February 2024. The latest SME Finance Monitor suggests that asset finance is currently used by a third of SMEs with 10-49 employees and by almost a quarter of SMEs with 50-249 employees.

“The asset finance market is expected to continue to grow in the near term supported by further growth in the vehicle finance sectors. More broadly, investment intentions remain subdued as a result of continued uncertainty about demand and pressure on net margins.”

For more information e-mail research@fla.org.uk

Finance & Leasing Association

Finance & Leasing Association